Global trend in changing search engine market shares

Shifts in global search engine market share are becoming increasingly apparent in real data collected from multiple analytical sources. This data often differs from global graphs, which, due to methodology and time lag, do not capture early trends. This article presents exclusively field observations that complement the broader statistical picture and indicate that the search engine ecosystem is changing faster than official aggregates show.

Global search engine market shares: stability on paper

Official global data for 2025 shows a relatively stable picture:

- Google: 89.6%

- Bing: 4.0%

- Yandex 2.5%

- Others

Statista further notes that Google’s share in March 2025 was 89.62%, the lowest point in more than two decades. These data are reliable, but they have an important limitation: they are based on global averages, panels, and aggregates that do not detect early shifts in user behavior.

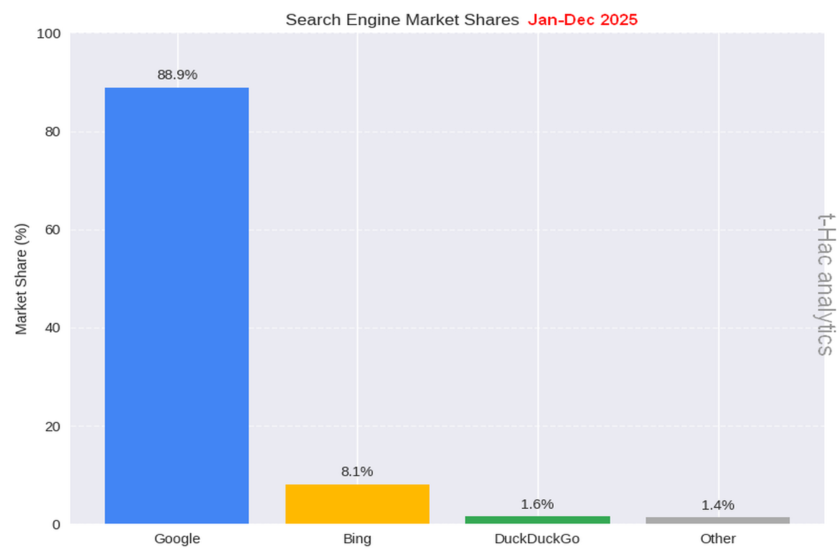

Field data show that the picture is different

- Google: 88,9 %

- Bing: 8,1 %

- DuckDuckGO: 1,6 %

- Ostali

In the last two months alone (November–December), there has been a huge change in real analytical flows, with different dynamics.

Data (observations from multiple analytical systems):

- Google: noticeable anomalies and fluctuations – a drop in traffic “liveliness”

- Bing: growth (20–25%)

- DuckDuckGo: growth

- Yandex: growth

This data does not represent global market share, but rather the actual activity of users coming through different search channels. This is an important distinction – and it is this distinction that reveals early trends that are not reflected in global graphs.

However, the data is not surprising, as previous research and analytical tracking show that Google is even more aggressively searching for content anonymously, but using it for its own purposes. Namely, it generates original content using AI in a hybrid, the result of which is displayed in SERP. Usually with a blurred or unclear source.

Why is there a discrepancy between global graphs and real data?

Global graphs measure:

- presence, not activity

- all devices and all regions

- averages across billions of users

- data with a 2–6 month delay

Field data measures:

- actual user flows

- real referrers

- activity, not just presence

- early shifts in habits

- segments that often lead trends

Therefore, it may happen that global graphs still show Bing at around 4%, while real data in certain segments show 20–25%.

This is not an error, but rather a time lag between what is already happening in practice and what global aggregates record with a delay.

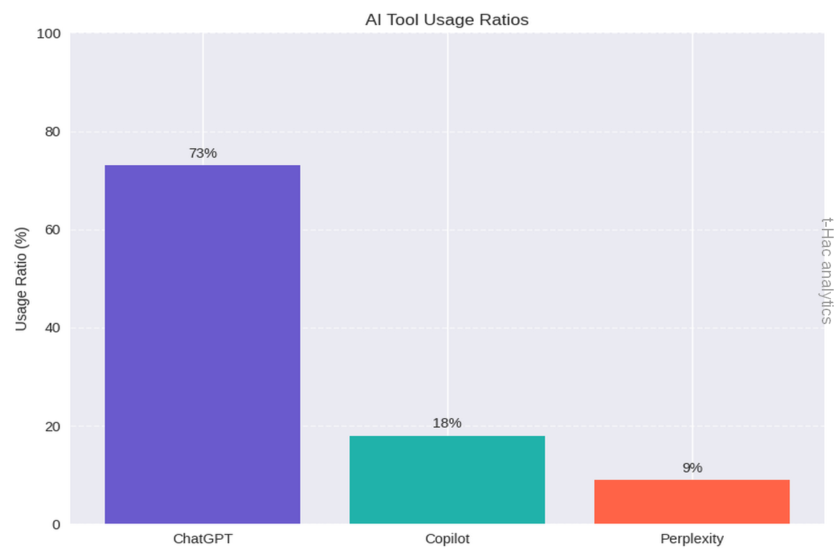

AI search engines: the fastest growing segment

AI search is currently the most dynamic part of the ecosystem. The data shows the following ratio within AI traffic:

- ChatGPT: 73%

- Copilot: 18%

- Perplexity: 9%

This ratio is not a global market share, but rather the share of AI tools that actually drive traffic. This is important because:

ChatGPT captures the most search intent,

Copilot is growing due to integrations in Windows and Edge,

Perplexity has a smaller but very active segment of power users.

Global AI search graphs mostly do not measure this at all, so data from the field is currently the only real indicator of what is really happening in this segment.

Alternative search engines: visible growth for the first time

Although the global market shares of DuckDuckGo and others (Yandex, Yahoo, Ecosia, Qwant, Brave, etc.) remain low (1.6% and 1.4%), the data shows:

- growth,

- greater user loyalty,

- an ever-increasing share of the “exodus” from Google.

This is the first time this has happened on such a scale and in such a short time frame, further confirming that the search space is diversifying and no longer dependent on a single player.

What does this mean for the future?

If we combine global data, local observations, and the dynamics of AI search, we get a clear picture:

the search ecosystem is transforming. Not only in terms of market share on paper, but above all in terms of actual usage.

Google remains big, but it is no longer the only player. Bing is growing faster, as global graphs show. AI search is taking over more and more search intent, and alternative search engines are gaining momentum. These are tectonic shifts that will become increasingly visible in official global statistics in the coming months and years.

Sources

- StatCounter Global Stats (november 2025)

- Statista: Global market share of search engines 2015–2025

- t-Hac Statistic 2025

- CNBC: Top Search Engines in 2025